1. A contract check-up exposes hidden fees

Sally thought her arrangement with her incumbent PBM was perfectly fine.

Then she discovered exactly how much money was lost to hidden contract terms and caveats that benefited the PBM more than Seashell Software. Sally and her benefit advisor enlisted RxBenefits and negotiated a one-year plan with more favorable contract terms and annual true-ups.

The software firm saved $92K in the first year. And Sally’s plan came with tailored solutions to protect her and her members.

2. Battle of the bulging budget

Getting to the lowest net cost requires more than a well-negotiated contract — high-quality clinical oversight to remove wasteful spending is also needed to protect the plan. With the Protect suite of clinical solutions offered by RxBenefits, some of Sally’s budget concerns are alleviated. The independent oversight offered by a clinical team who leverages chart notes and lab results ensures her members get the right treatment at the right price.

For example, RxBenefits PharmDs noticed three of Sally’s pretend employees taking Ozempic® — a popular next-generation type 2 diabetes drug that’s known for helping people lose weight. But only one of those employees is actually diabetic. So, her program denied two of those claims. The results?

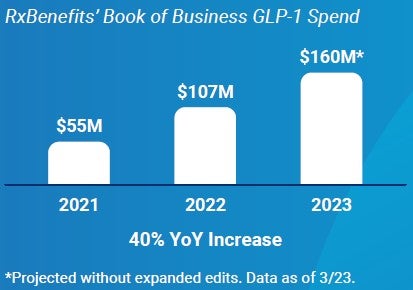

Reversing a Troubling Trend

3. Getting the best outcome at the right price?

Like most plans, Sally’s has seen an increase in costs for anti-inflammatory medications and dermatologic agents – two categories of popular high-cost specialty drugs. Many plan sponsors don’t realize these brands can often be swapped for equally effective, more

cost-efficient medications.

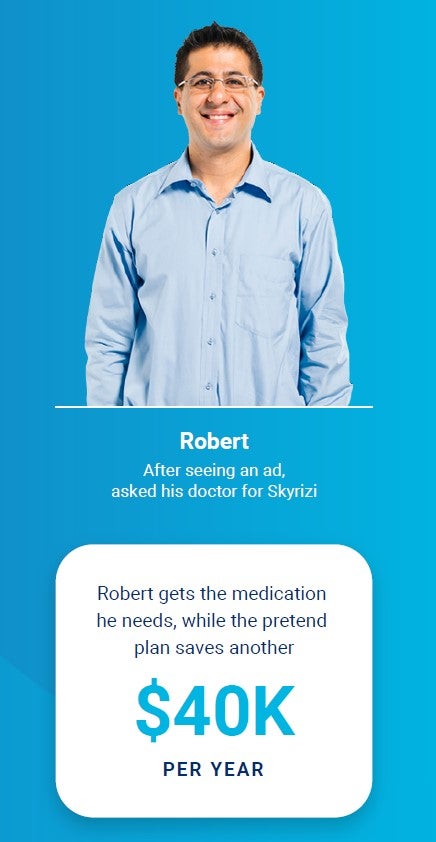

Seashell Software’s pretend VP of Legal, Robert, asked his provider for a prescription for Skyrizi because he needs relief from his plaque psoriasis. Robert saw television ads promoting the drug. His doctor prescribed it without knowing the latest clinical and economic information. A Skyrizi prescription will cost Robert’s plan $70K a year.

RxBenefits identified him as someone who has an opportunity for intervention. After reviewing chart notes, a PharmD contacted Robert’s prescriber to discuss alternative treatments.

After working together, our expert and Robert’s doctor determined Robert hasn’t tried Otezla, which costs $30K a year and may be more effective at treating his psoriasis. They make the switch.

4. Not all plans need alternative funding

Sally and her pretend benefit advisor sat down to determine whether alternative funding solutions were right for her plan. After looking at options for patient assistance and manufacturer copay assistance, they determined these solutions won’t help her members.

Because alternative funding isn’t right for every plan.

But thanks to an integrated point-of-sale drug discount program, all of the plan’s generic prescriptions will be automatically screened for possible discounts without any action needed by the plan sponsor or their members.

5. When stop-loss isn’t enough

Sally has a pretend daughter, Marie. Marie was diagnosed with a rare genetic disorder, hypophosphatasia, and her doctor prescribed Strensiq. With an annual recurring price tag of $1.2M, Seashell Software’s stop-loss coverage wouldn’t be enough to cover this extremely expensive treatment.

Sally’s benefit advisor helped her put supplemental stop-loss in place when designing her benefits plan. When her daughter started to need expensive treatments, the plan was eligible for reimbursement once the claim hit the $250K deductible. Sally’s plan saw a net savings of $880K after accounting for the annual premium of $68K.

6. Robust pharmacy benefits

Despite numerous risks that could have threatened Sally’s bottom line — or even the overall financial viability of her company — she’s providing a robust pharmacy benefit to the employees of Seashell Software, because their plan has layers of protection in place.

With those pretend interventions we’ve mentioned, this fictional business will save more than $1.5M in pretend wasteful pharmacy spend.

Annual Savings

$92K + $480K + $40K + $880K = $1.50M

Thanks to these savings, they’ve been able to pretend-upgrade their cloud network infrastructure, pretend to sponsor a local coding

event for high-school students, and hire two new pretend UX designers.

And clients like Sally — but who exist in real life and face these real-life problems — really are seeing considerable savings from more favorable contracts, expert clinical oversight of utilization, and traditional and supplemental stop-loss protection. For real.

Meet Sally Sallerson, CFO of Seashell Software. She wants to provide a comprehensive benefit plan that meets her business goals and prioritizes member health and safety.

Meet Sally Sallerson, CFO of Seashell Software. She wants to provide a comprehensive benefit plan that meets her business goals and prioritizes member health and safety.